7 Low-Code Solutions for Financial Services 2024

Low-code platforms are revolutionizing app development in banking. Here's what you need to know:

- Build apps up to 7x faster than traditional coding

- Cut development costs by $50k-$100k per app

- Let non-tech staff create apps, sparking innovation

- Built-in security features for financial compliance

Top 7 low-code platforms for finance in 2024:

These solutions offer:

- Pre-built finance templates

- Easy integration with existing systems

- AI-powered development tools

- Strong security and compliance features

Real results: UK fintech thinkmoney used OutSystems to boost conversions 30% in 4 weeks and cut marketing costs 20%.

The low-code market in finance is set to explode, with Gartner predicting 65% of app development will use low-code by 2024.

For banks looking to innovate faster and improve customer experiences, low-code platforms are becoming essential tools.

Related video from YouTube

1. Mendix

Mendix is a top low-code platform for financial services in 2024. It offers tools to speed up app development and improve operations. Here's why banks and financial firms choose Mendix:

Fast Development with Finance-Focused Tools

Mendix helps financial institutions build apps up to 7 times faster than regular coding. This speed is key in finance, where being first to market matters.

The platform has ready-made templates for finance, including:

- Customer Onboarding: Automate new client sign-ups

- Banking Apps: Build mobile and web apps with features like biometrics and transfers

- Complaint Tracker: Manage customer issues for better compliance

Real Results from Big Banks

Banks worldwide use Mendix to change how they work:

"Rabobank IDB built a full cross-channel system for customer onboarding and online banking. The app now serves over 500,000 customers and has 4.7 ratings on iOS and Android."

"ABN AMRO made more than 60 low-code apps to automate internal processes, cutting development needs by 20% to 40%."

"ING's Document & Content Services team created an app to improve customer communication, running over 2,200 automated tests for function and compliance."

Plays Well with Others and Stays Secure

Mendix connects easily to existing systems, which is crucial for banks with complex IT. It offers:

- REST connectors and database links

- Event Brokers for real-time data sharing

- Strong security to meet tough finance standards

AI Boost

Mendix uses AI to make development even faster:

- Mendix AI Assistance (Maia): Helps devs build smarter apps

- Mendix ML Kit: Add AI models without third-party services

Run It Anywhere

Banks can use Mendix apps in different ways:

- Public cloud

- Private cloud

- Mix of both

- On their own servers

This means banks can meet their security needs while still using cloud when it helps.

Team Up and Stay in Control

Mendix helps business and IT teams work together, which is key in finance where expert knowledge matters. It includes:

- Tools to manage app portfolios

- App Insights to watch and improve performance

- Ways to manage projects using Agile methods

Paul Kammerer from Rabobank sums it up:

"We decided to use Mendix in all areas where speed and agility are essential."

2. OutSystems

OutSystems is a low-code platform that's making waves in financial services. It's all about speed, security, and staying ahead of the game.

Build Fast, Stay Secure

With OutSystems, financial firms can crank out apps up to 7 times faster than old-school coding. In finance, being first matters. A lot.

The platform comes loaded with finance-friendly goodies:

- Quick customer onboarding

- Banking apps with fancy features (think biometric logins)

- Tools to keep the regulators happy

Real Results, Real Fast

Take thinkmoney, a UK fintech. They used OutSystems to overhaul how they sign up new customers. The results? Pretty impressive:

"We saw a 30% jump in conversions in just four weeks. Our marketing costs dropped by 20%. And we moved our entire account opening process online in only 7 weeks."

That's the kind of speed that turns heads in finance.

Plays Nice with Others, Keeps Secrets Safe

Got a complex IT setup? No problem. OutSystems is built to connect:

- Hooks right into Microsoft SQL Server and Oracle

- Creates integration methods without you lifting a finger

- Manages all your connections in one place, no coding required

And security? They've got it locked down tight. It's built to keep financial data safe and regulators off your back.

AI Boost, Without the Risk

Finance is going all-in on AI, and OutSystems is right there with it. Their AI tools help you build faster, but safely. As Tiago Azevedo, OutSystems CIO, puts it:

"With the built-in guardrails of low-code platforms, teams can experiment and innovate freely without the privacy and security concerns associated with public AI models."

Your Cloud, Your Way

OutSystems lets you pick where you want to live:

- Public cloud

- Private cloud

- Mix and match

- Keep it in-house

You choose what works for your security needs and how you like to run things.

What's It Going to Cost Me?

OutSystems offers a few options:

- Free trial: 1 environment, up to 100 users

- Basic: $4,000/month for 1,000 users

- Standard: $10,000/month, unlimited users

It's not the cheapest kid on the block, but for financial firms looking to move fast and break things (without actually breaking anything important), it could be worth every penny.

OutSystems is giving financial services the tools to stay quick, compliant, and cutting-edge. If you're a bank or fintech looking to level up in 2024, it's definitely worth a look.

3. Unqork

Unqork is a low-code platform built for financial services. It's all about speeding up digital transformation while keeping things secure and compliant.

Build Fast, Stay Focused

With Unqork, financial companies can create complex apps without writing code. This means they can innovate quickly and keep up with market demands.

The platform uses drag-and-drop tools and pre-built components. This setup makes it easy for IT and business teams to work together on new apps. It's perfect for finance, where you need input from different experts.

Security: Not Just a Feature

In finance, security isn't optional. Unqork gets this. They've baked top-notch security right into the platform. This lets financial companies focus on innovation without worrying about compliance.

Some key security features:

- Control who can access what, down to specific parts of an app

- Regular security checks, including twice-yearly hacking tests

- Yearly SOC Type 2 exams

These measures help finance companies meet tough security standards without endless code reviews.

Real Results

Big names in finance are using Unqork. We're talking Goldman Sachs, Marsh, and BlackRock.

Here's what Joseph Lo from Broadridge has to say:

"Unqork allows me to take my ideas and what we are hearing from our clients and bring them to life. It gives innovation leads like me the ability to rapidly prototype, build MVPs, then iterate on product-market fit before we go to market in full."

This shows how Unqork helps financial companies test and refine new ideas fast - a big deal in the fast-moving world of fintech.

Tackling Industry Problems

Unqork aims to fix a big issue in finance: too many manual processes. Check out these stats:

- 17% of financial services still do all their data matching by hand

- 34% rely on manual workflows for daily operations

- Almost 70% of leaders made big decisions based on wrong financial info due to manual accounting

By digitizing these processes, Unqork helps finance companies boost accuracy, efficiency, and risk management.

Always Improving

Unqork keeps updating its platform. Their Winter 2024 release added some cool new features:

- Tools for creating reusable components and apps

- A pre-built system for managing cases

- New ways to build apps faster and more collaboratively

- Open standards for no-code apps, giving users more flexibility

These updates show Unqork is committed to growing with the finance industry's needs.

AI for the Future

Unqork knows AI is big in finance. That's why they've added the GenAI Connector. This tool lets finance companies plug in AI tools and quickly launch AI-powered apps, keeping them at the cutting edge of tech.

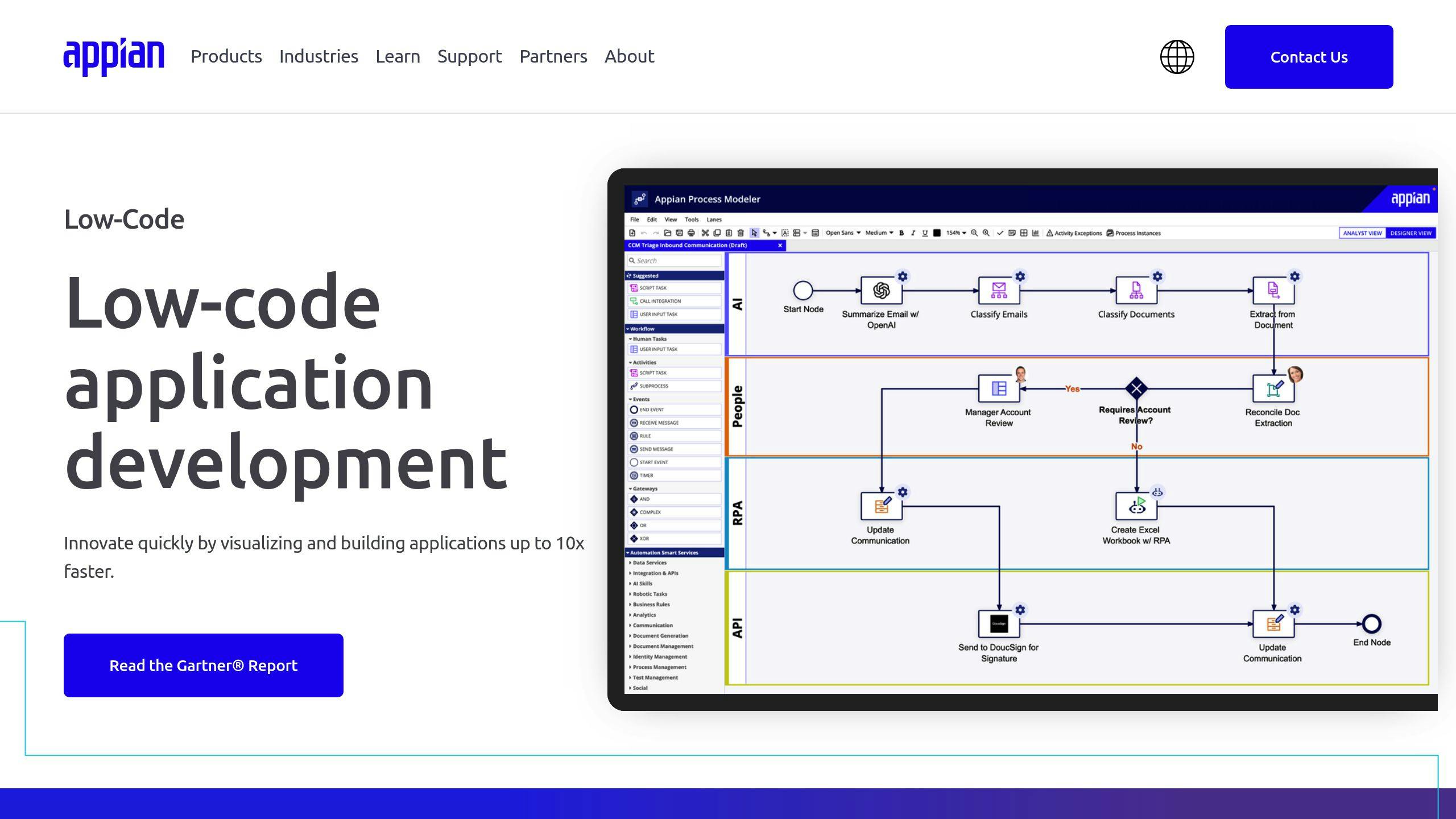

4. Appian

Appian is a low-code platform that's making waves in financial services. It's fast, secure, and scalable - just what banks need to go digital without turning into tech companies.

Banking Made Easy

Appian is great at simplifying complex banking tasks. Take customer onboarding, for example. One big financial firm used Appian to slash their onboarding time from weeks to days. That's a win for customer happiness and staying ahead of the competition.

But it doesn't stop there. Appian handles:

- Loan origination

- Account opening

- Compliance monitoring

- Risk management

Plays Nice with Others

One of Appian's best tricks? It connects smoothly with existing bank systems. No need to tear everything down and start over. Its drag-and-drop interface means you can link things up without being a coding wizard.

Appian's data fabric is pretty cool, too. It updates access controls on the fly. So if someone new takes over a support case, the security changes happen automatically. No manual tweaks needed.

Fort Knox-Level Security

In banking, security is everything. Appian's got it covered with:

- Tough access controls

- Data encryption

- Detailed audit trails

It also makes complex security setups a breeze. An Appian engineer puts it this way:

"With Appian's synced data, you don't have to put indices on columns, you don't have to optimize your query, and you don't have to worry about how many joins are going to happen and in what order."

This approach keeps things secure without slowing things down - crucial for banking operations.

Room to Grow

Appian's pricing is flexible, so banks can scale up as they need to. That's key in the fast-changing world of fintech.

The low-code setup means banks can quickly build and test new ideas. Whether it's mobile banking apps or self-service portals, Appian helps get them up and running fast.

Real Results

Banks using Appian are seeing real benefits. Pablo d., who works in Utilities, says:

"We can develop apps and tools much faster and deploy them incredibly fast. In this way, we can digitalize our company and standardize data inputs to optimize and enhance data-driven decisions."

In banking, being quick to market can make all the difference.

It's not just about speed, though. One insurance company paired Appian with ApiX-Drive to automate policy management. The result? They processed policies 40% faster. In financial services, that kind of efficiency boost can be a game-changer, improving customer satisfaction and cutting costs.

5. Microsoft Power Platform

Microsoft Power Platform is changing the game in financial services with its low-code approach. It's a toolkit that helps banks and fintech companies create custom apps without needing a huge dev team.

Power Apps, the platform's core, is all about speed. Financial firms can quickly build apps for:

- Customer onboarding

- Loan processing

- Risk assessments

How quick is it? A government IT specialist said:

"The solution saves time for organizations by eliminating manual coding and providing ready-to-use solutions."

In finance, where being first to market matters, this speed is key.

Power Platform plays nice with other systems. It connects easily to Microsoft 365, Dynamics 365, and SharePoint. For banks, this means using existing data without starting over.

Security is everything in finance, and Power Platform takes it seriously:

- Role-based access controls

- Cloud hosting on Microsoft Azure

- Common Data Service for secure data management

These features help banks meet tough compliance rules without endless security checks.

The platform also includes AI tools that financial firms can use without hiring data scientists. This opens up options like:

- Chatbots for customer service

- Fraud detection algorithms

- Predictive analytics for risk management

While specific finance case studies are limited, companies are using Power Apps to automate processes, improve data accuracy, and speed up decision-making. For financial services, this means faster operations, better customer service, and sharper insights.

Power Platform works for firms of all sizes:

- Small fintech startups

- Mid-size credit unions

- Large international banks

Its flexible pricing lets financial firms start small and scale up as needed.

It's not perfect - it's not as customizable as some other low-code options. But for financial services wanting to innovate quickly without a big IT overhaul, it's a solid choice. Power Platform brings Microsoft's ecosystem to tackle finance's unique challenges, helping companies stay nimble in a fast-paced industry.

sbb-itb-96038d7

6. Endgrate

Endgrate is shaking up the financial services world with its low-code integration solution. It's a breath of fresh air for banks and fintech companies looking to step up their digital game without diving deep into complex coding.

Here's the deal: Endgrate connects over 100 third-party integrations through a single API. That's huge for financial firms dealing with a mess of disconnected systems. It's like having a universal translator for all your apps.

What does this mean for banks and fintech companies?

- Less time and money spent on development

- Smoother data flow between apps

- A more efficient system overall

But here's the kicker: Endgrate doesn't skimp on security. They've got enterprise-grade protection baked in. In an industry where data breaches can be catastrophic, that's not just nice to have - it's essential.

Endgrate also lets you customize data models and configure everything to your heart's content. Whether you're onboarding customers, assessing risks, or processing transactions, you can tweak the platform to fit your needs like a glove.

Need to integrate a new service ASAP? Endgrate's got you covered with on-demand integrations. In the fast-paced finance world, that kind of speed can give you a serious edge.

While we don't have specific case studies for finance, it's easy to see how Endgrate could make a big splash:

- Speeding up digital transformation

- Creating smoother customer experiences

- Cutting down on IT headaches (and costs)

And get this: Endgrate offers a free plan alongside paid options. That means both scrappy startups and big banks can get in on the action.

For financial services companies eyeing low-code solutions in 2024, Endgrate is worth a serious look. It tackles the big integration challenges head-on, without compromising on security or flexibility. That's a combo that could be a game-changer in the ongoing digital transformation of finance.

7. Creatio

Creatio's low-code platform is shaking up the financial services world. It's fast, flexible, and secure - exactly what banks and fintech companies need.

Banking-Focused Features

Creatio isn't your average low-code platform. It's built specifically for banking:

- Loan Management: Automates approvals and uses flexible checklists. Less paperwork, faster decisions.

- Dynamic Product Catalog: Quick updates to stay competitive.

- Customer Service: Centralizes feedback and uses Net Promoter Score to boost satisfaction.

Plays Well with Others

Banks need their systems to communicate. Creatio delivers:

- Integration with .Net tools, REST, SOAP, and OData

- Open API for connecting to existing systems

This means banks can modernize without scrapping their old systems. Big win for established banks.

Serious About Security

When it comes to financial data, security is non-negotiable. Creatio's got it covered:

- SOC 2 Type II compliant

- Automated Anti-Money Laundering (AML) workflows

- Digital identity verification tools

Banks can innovate without compromising on regulatory standards.

Built to Grow

As banks expand, Creatio keeps pace:

- Scalable architecture handles more transactions

- Customizable workflows adapt to business growth

Real-World Impact

Financial institutions using Creatio are seeing results. A banking user from a large company said:

"Creatio is always going the extra mile on its product improvement and serving its customers."

Another financial services user reported:

"Using the platform, we created custom sales processes and product workflows, configured customer onboarding. Process automation helped us reduce manual workload, create a unified work environment with shared data, streamline customer onboarding."

These comments show how Creatio boosts efficiency and improves customer experience in finance.

The Takeaway

For financial services wanting to innovate quickly without sacrificing security or compliance, Creatio's a solid choice. Its banking-specific features, strong integration capabilities, and scalability make it a top contender for 2024.

It might not be the biggest name out there, but Creatio's focused approach to financial services and positive user feedback make it worth considering for banks and fintech companies looking to speed up their digital transformation.

How to Put These Solutions to Work

Let's dive into how you can make low-code platforms work for your financial organization:

Assess Your Compliance Landscape

First things first: take a good look at your current compliance challenges. What's causing headaches? Which processes are eating up too much time? Pinpoint these issues - they're prime candidates for a low-code makeover.

Choose the Right Platform

Not all low-code platforms are created equal. You need one that fits your financial institution like a glove. Here's what to look for:

- Rock-solid security features

- Built-in compliance frameworks

- Plays nice with your existing systems

- Room to grow as your business expands

Take Mendix, for example. They offer finance-specific templates and top-notch security. It's a popular choice for banks for good reason.

Lock Down Security

In finance, security isn't just important - it's everything. Your chosen platform should offer:

- End-to-end encryption

- Multi-factor authentication

- Role-based access control

Creatio is a good example here. They're SOC 2 Type II compliant and come with automated Anti-Money Laundering (AML) workflows baked in.

Play Well with Others

Your new low-code platform needs to get along with your current systems. Look for pre-built connectors and APIs to make this happen. It'll make the transition smoother and keep your data consistent.

OutSystems shines in this area. They make it a breeze to connect with Microsoft SQL Server and Oracle databases.

Train Your Team

Don't skimp on training. Both your tech wizards and non-tech staff need to know how to use these tools effectively.

Take a page from Credit Agricole Bank Polska's book. They created their own in-house training program for new hires on the Eximee platform. It's helped them get everyone on board and using the system like pros.

Start Small, Then Grow

Don't try to boil the ocean. Start with a pilot project to show what these tools can do.

Coast2Coast Mortgage nailed this approach. They used Blaze's low-code platform to build an app that automates sales and commission tracking. This small win opened the door for bigger projects down the line.

Keep Improving

Once you're up and running, don't just set it and forget it. Keep an eye on:

- How well it's performing

- What users are saying

- Any new compliance rules

Be ready to tweak things as needed. The regulatory landscape is always shifting, and your low-code solutions should keep pace.

What's Next for Low-Code

The low-code landscape in financial services is set for a major shake-up. Let's peek into the crystal ball and see what's cooking for 2024 and beyond.

AI: The New Kid on the Block

AI is about to crash the low-code party. By 2024, we'll see AI-powered features popping up left and right, making app development a breeze. Mendix's AI assistant, Maia, is already showing us what's possible. Soon, even your average Joe in finance will be whipping up smart apps like a pro.

Hyper-Automation: Full Steam Ahead

Banks are going all-in on hyper-automation, and low-code platforms are leading the charge. Gartner's crystal ball shows a 54% jump in low-code tools by 2024, all thanks to this hyper-automation craze.

Citizen Developers: The People's Revolution

Move over, IT guys. By 2024, Gartner says 80% of tech products will come from non-techies. In finance, this means your friendly neighborhood banker might just code up the next big thing.

Tailor-Made for Finance

Low-code platforms are getting a finance makeover. Expect more ready-to-use templates for banking. Unqork's already on it with pre-built systems for finance. This trend's only going to pick up steam.

Fort Knox-Level Security

With regulations changing faster than you can say "compliance", low-code platforms are beefing up their security game. Built-in features for data protection and regulatory reporting will be the new normal.

Tech Cocktail

Low-code's not stopping at AI. It's cozying up to blockchain, IoT, and other tech buzzwords. This mash-up will cook up some wild new financial products.

Show Me the Money

The low-code market in finance is about to explode. Grand View Research predicts the banking software market will hit $21 billion by 2030. Gartner's betting that by 2024, low-code will be behind 65% of all app development.

Real-World Magic

thinkmoney, a UK fintech, took OutSystems for a spin and hit the jackpot:

"We saw a 30% jump in conversions in just four weeks. Our marketing costs dropped by 20%. And we moved our entire account opening process online in only 7 weeks."

This kind of turbo-charged transformation will soon be the new normal.

The Road Ahead

It's not all smooth sailing. Banks will need to train up their crew and maybe bring in some fresh talent. They'll also need to keep a tight ship when it comes to managing all these new citizen-developed apps.

But the payoff? Huge. Banks using low-code will be able to:

- Dance to market changes faster than ever

- Treat customers like VIPs with personalized experiences

- Slash IT costs

- Let their non-tech staff unleash their inner innovator

As we roll into 2024 and beyond, low-code platforms will be the secret sauce in finance's digital transformation recipe. They'll help banks not just keep up, but lead the pack in financial innovation.

Wrap-Up

Low-code platforms are changing the game in financial services. They're not just a fad - they're becoming a must-have for banks and fintech companies looking to stay ahead in the digital race.

Why is low-code making such a splash in banking? Let's break it down:

Speed: These platforms are turbocharging development. Take thinkmoney, a UK fintech using OutSystems:

"We saw a 30% jump in conversions in just four weeks. Our marketing costs dropped by 20%. And we moved our entire account opening process online in only 7 weeks."

That's the kind of quick change that's becoming the new normal.

Citizen Developers: Low-code tools are bridging the gap between IT and business teams. Gartner thinks that by 2024, 80% of tech products will come from non-techies. That's a lot of new ideas coming from all corners of financial organizations.

Security: In finance, data protection is key. Many low-code platforms come with built-in security features and compliance tools. This makes it easier for banks to innovate while playing by the rules.

Cost: Building software the old way can be pricey. Low-code offers a cheaper option. One study found that hiring a full-time developer can cost up to $28,584, while low-code can do the job for less money and time.

Integration: Today's financial services need systems that talk to each other. Low-code platforms are good at connecting these dots. Coast2Coast Mortgage, for example, used Blaze to create an app that works smoothly with QuickBooks and their loan system.

AI: Looking ahead, low-code platforms are starting to use AI to make development even faster. Mendix's AI assistant, Maia, is just the start of what's possible when AI meets low-code.

The impact of low-code in finance is clear. From faster loans to better customer experiences, these platforms are helping banks and fintech companies keep up with rapid changes.

As Max Tsurbeliov says:

"Words cannot fully describe the immense impact low-code platforms make on banking app development."

As we head into 2024 and beyond, low-code platforms will keep driving innovation in finance. They're not just changing how banks build software - they're reshaping the whole financial services landscape, making it more responsive, efficient, and focused on customers than ever before.

FAQs

What is low-code for banking?

Low-code platforms are changing how banks create and launch applications. These tools let financial institutions build software with less hand-coding, using visual interfaces and ready-made components instead.

Why is low-code catching on in banking?

- It's FAST. Banks can build apps up to 7 times quicker than old-school coding.

- It saves money. Low-code can cut $50,000 to $100,000 off app development costs.

- It's flexible. Banks can make quick changes to keep up with market needs.

- It's inclusive. Even non-tech staff can help build apps, sparking new ideas.

The results? Pretty impressive. Take thinkmoney, a UK fintech. They used OutSystems (a low-code platform) and here's what happened:

"We saw a 30% jump in conversions in just four weeks. Our marketing costs dropped by 20%. And we moved our entire account opening process online in only 7 weeks."

This kind of quick change is becoming the new normal in finance.

What's next for low-code? It's set to take off. Gartner thinks that by 2024, 65% of app development projects will use low-code. The global market could hit $32 billion in 2024, growing 21% year-over-year.

For banks looking to boost their digital game and make customers happier, low-code is a big deal. It's not just about building apps faster - it's about keeping up in a fast-changing financial world.

Related posts

Ready to get started?