Using the Sage 100 API to Get Tax Schedules in PHP

Introduction to Sage 100 API for Tax Schedules

Sage 100 is a comprehensive enterprise resource planning (ERP) solution tailored for small to medium-sized businesses. It offers a robust suite of tools for managing accounting, inventory, distribution, and more. One of its key features is the ability to handle complex tax schedules, making it an essential tool for businesses with intricate tax requirements.

For developers, integrating with the Sage 100 API provides the opportunity to automate and streamline tax-related processes. By accessing tax schedules programmatically, businesses can ensure accurate tax calculations and compliance. For example, a developer might use the Sage 100 API to retrieve tax schedules and integrate them into a custom billing system, ensuring that all transactions adhere to the latest tax regulations.

Setting Up a Test Environment for Sage 100 API Integration

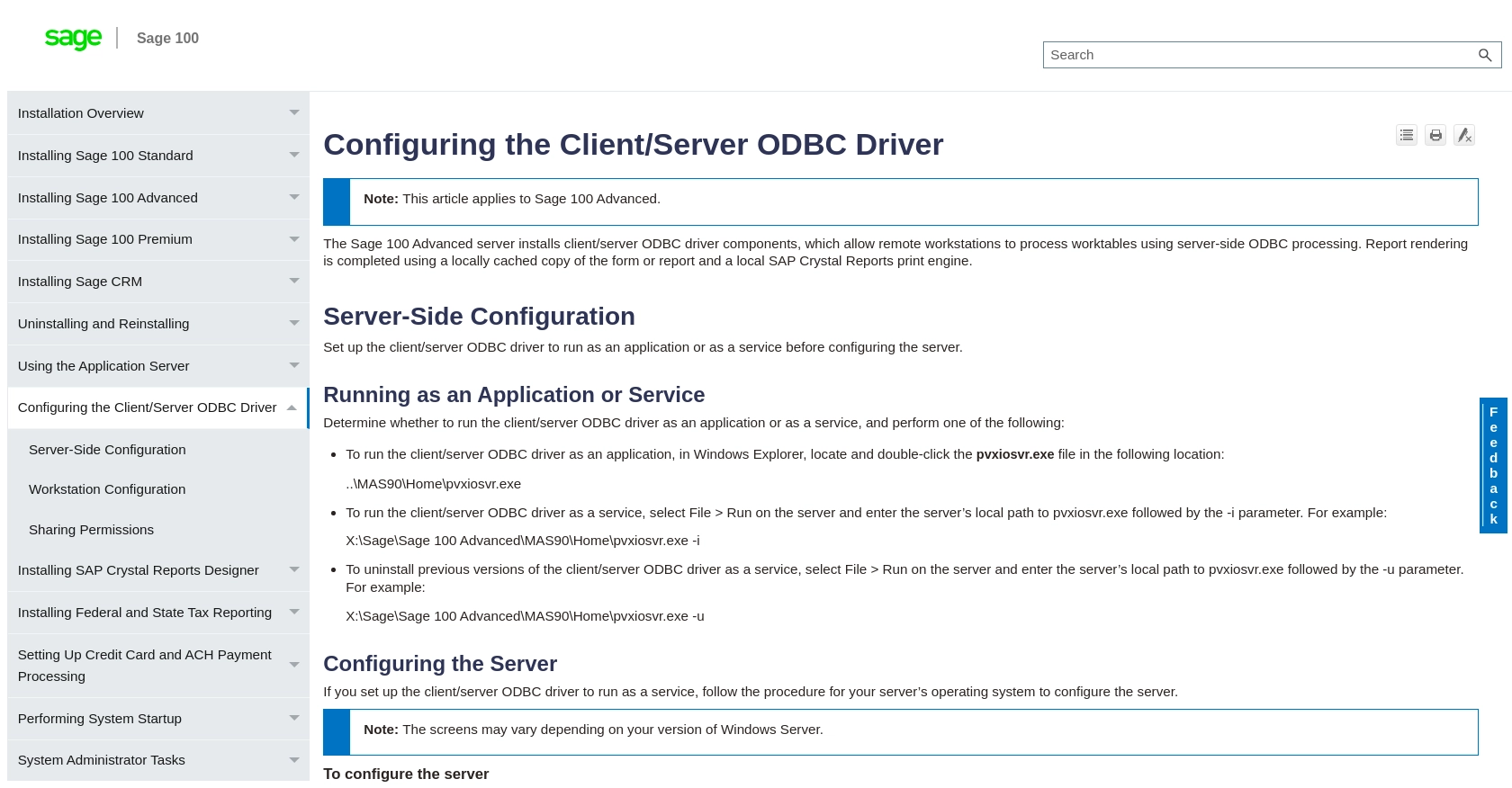

Before you can start interacting with the Sage 100 API to retrieve tax schedules, it's essential to set up a test environment. This involves configuring the Sage 100 ODBC driver and creating a Data Source Name (DSN) to connect to the Sage 100 database. This setup allows you to safely test API interactions without affecting live data.

Installing and Configuring the Sage 100 ODBC Driver

To begin, ensure that the Sage 100 ODBC driver is installed on your system. This driver is crucial for establishing a connection to the Sage 100 database. Follow these steps to configure the driver:

- Access the ODBC Data Source Administrator on your system.

- Create a new DSN by selecting the appropriate Sage 100 ODBC driver.

- Enter the necessary connection details, including the server name, database, and authentication settings.

For detailed instructions, refer to the Sage 100 ODBC Driver Configuration Guide.

Creating a Sage 100 Test Account

To test API calls, you need access to a Sage 100 test account. If you don't have one, contact your Sage 100 administrator to set up a sandbox environment. This will allow you to experiment with API requests without impacting your production data.

Configuring Sage 100 for API Access

Once your test account is ready, configure Sage 100 to allow API access:

- Ensure that the client/server ODBC driver is running as a service or application on the server.

- Configure the server settings to allow remote access, ensuring the correct permissions are set.

- Test the ODBC connection to confirm successful setup.

For more information on server configuration, see the Sage 100 Server Configuration Guide.

Generating API Credentials for Sage 100

With the ODBC driver and test account configured, the next step is to generate the necessary API credentials:

- Log into your Sage 100 test account.

- Navigate to the API settings section and create a new API application.

- Obtain the client ID and client secret, which will be used for authentication in your PHP application.

Ensure you store these credentials securely, as they are required for making API requests.

sbb-itb-96038d7

Making API Calls to Retrieve Tax Schedules from Sage 100 Using PHP

Now that your Sage 100 environment is set up, you can proceed to make API calls to retrieve tax schedules using PHP. This section will guide you through the necessary steps, including setting up your PHP environment, writing the code to interact with the Sage 100 API, and handling potential errors.

Setting Up Your PHP Environment for Sage 100 API Integration

Before making API calls, ensure your PHP environment is properly configured. You'll need PHP 7.4 or later and the ODBC extension enabled. You can verify your PHP version and extensions by running the following command:

php -v

php -m | grep odbc

If the ODBC extension is not enabled, you can enable it by editing your php.ini file and uncommenting the line:

extension=odbc

Restart your web server to apply the changes.

Writing PHP Code to Connect to Sage 100 and Retrieve Tax Schedules

With your environment ready, you can write the PHP code to connect to the Sage 100 database and retrieve tax schedules. Below is a sample script demonstrating how to achieve this:

<?php

// Define the DSN and credentials

$dsn = 'SOTAMAS90';

$user = 'your_username';

$password = 'your_password';

// Establish a connection to the Sage 100 database

$conn = odbc_connect($dsn, $user, $password);

if (!$conn) {

die('Connection failed: ' . odbc_errormsg());

}

// Define the SQL query to retrieve tax schedules

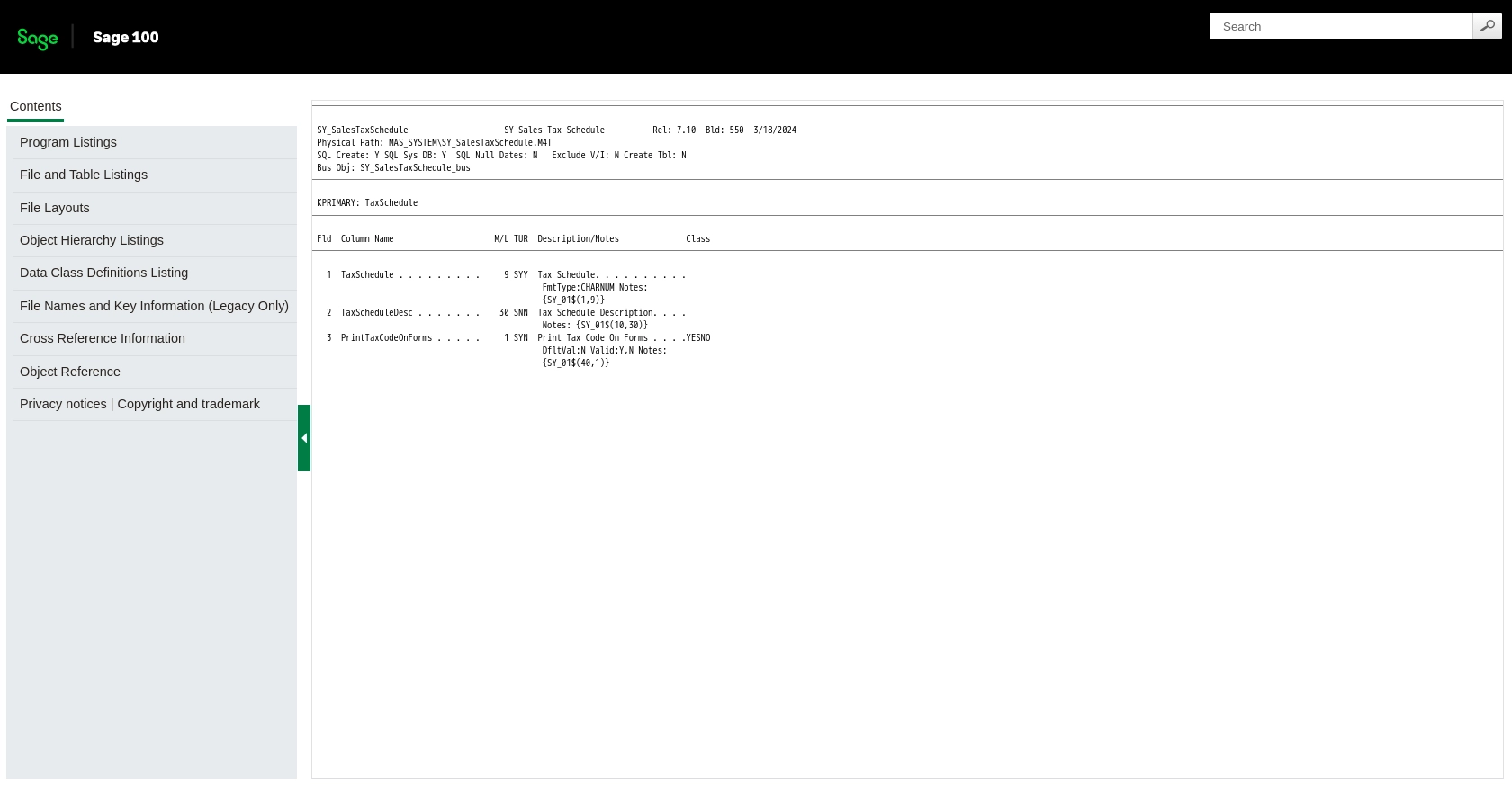

$query = "SELECT * FROM SY_SalesTaxSchedule";

// Execute the query

$result = odbc_exec($conn, $query);

if (!$result) {

die('Query failed: ' . odbc_errormsg());

}

// Fetch and display the results

while ($row = odbc_fetch_array($result)) {

echo 'Tax Schedule: ' . $row['TaxSchedule'] . '<br>';

echo 'Description: ' . $row['Description'] . '<br>';

echo '<br>';

}

// Close the connection

odbc_close($conn);

?>

Replace your_username and your_password with your actual Sage 100 credentials. This script connects to the Sage 100 database using the ODBC driver, executes a query to retrieve tax schedules, and displays the results.

Verifying Successful API Calls and Handling Errors

After running the PHP script, verify the output to ensure the API call was successful. You should see a list of tax schedules along with their descriptions. If the script encounters any errors, it will display an error message.

To handle errors effectively, consider implementing try-catch blocks and logging mechanisms to capture and analyze issues. This will help you troubleshoot and resolve any connection or query problems.

Checking the Sage 100 Test Environment for Data Accuracy

Once you have retrieved the tax schedules, cross-check the data with your Sage 100 test environment to ensure accuracy. This step is crucial for validating that your API interactions are functioning as expected.

For more detailed information on the Sage 100 API and its capabilities, refer to the Sage 100 API Documentation.

Conclusion and Best Practices for Using Sage 100 API in PHP

Integrating with the Sage 100 API to retrieve tax schedules using PHP can significantly enhance your business's efficiency by automating tax-related processes. By following the steps outlined in this guide, you can ensure a seamless connection to the Sage 100 database and accurate data retrieval.

Best Practices for Secure and Efficient Sage 100 API Integration

- Secure Credentials: Always store your API credentials securely. Consider using environment variables or a secure vault to manage sensitive information.

- Handle Rate Limiting: Be aware of any rate limits imposed by the Sage 100 API. Implement retry logic and exponential backoff strategies to handle rate limit errors gracefully.

- Data Validation: Regularly validate the data retrieved from the API against your Sage 100 test environment to ensure accuracy and consistency.

- Error Handling: Implement robust error handling using try-catch blocks and logging to capture and address any issues promptly.

Streamlining Integrations with Endgrate

While integrating with the Sage 100 API can be highly beneficial, managing multiple integrations can become complex and time-consuming. Endgrate offers a unified API solution that simplifies the integration process across various platforms, including Sage 100.

By leveraging Endgrate, you can save time and resources, allowing you to focus on your core product development. With a single API endpoint, you can manage multiple integrations efficiently, providing an intuitive experience for your customers.

Explore how Endgrate can transform your integration strategy by visiting Endgrate today.

Read More

- https://endgrate.com/provider/sage100

- https://help-sage100.na.sage.com/InstallGuide/2022/Content/InstallGuide/Config_ODBC_Driver.htm

- https://help-sage100.na.sage.com/2022/FLOR/index.htm#File_Layouts/Library_Master/SY_SalesTaxSchedule.htm?Highlight=SY_SalesTaxSchedule

- https://help-sage100.na.sage.com/2022/FLOR/index.htm#File_Layouts/Library_Master/SY_SalesTaxScheduleDetail.htm?Highlight=SY_SalesTaxScheduleDetail

- https://help-sage100.na.sage.com/2022/FLOR/index.htm#File_Layouts/Library_Master/SY_SalesTaxCodeDetail.htm?Highlight=SY_SalesTaxCodeDetail

- https://help-sage100.na.sage.com/2022/FLOR/index.htm#File_Layouts/Library_Master/SY_SalesTaxCode.htm?Highlight=SY_SalesTaxCode

Ready to get started?