Using the Sage Accounting API to Get Tax Rates (with Python examples)

Introduction to Sage Accounting API

Sage Accounting is a robust cloud-based accounting solution tailored for small to medium-sized businesses. It offers a comprehensive suite of tools to manage finances, including invoicing, cash flow, and tax compliance. Sage Accounting's flexibility and user-friendly interface make it a popular choice for businesses looking to streamline their financial operations.

Integrating with the Sage Accounting API allows developers to automate and enhance financial processes by accessing real-time accounting data. For example, developers can use the API to retrieve tax rates, enabling seamless tax calculations and compliance within their applications. This integration can significantly reduce manual data entry and errors, providing a more efficient workflow for businesses.

Setting Up Your Sage Accounting Test/Sandbox Account

Before you can start using the Sage Accounting API, you'll need to set up a test or sandbox account. This environment allows you to safely experiment with API calls without affecting live data. Follow these steps to get started:

Create a Sage Developer Account

To begin, you need a Sage Developer account. This account will enable you to register and manage your applications, obtain client credentials, and specify key details such as callback URLs.

- Visit the Sage Developer Portal and sign up using your GitHub account or an email address.

- Follow the instructions to complete your registration.

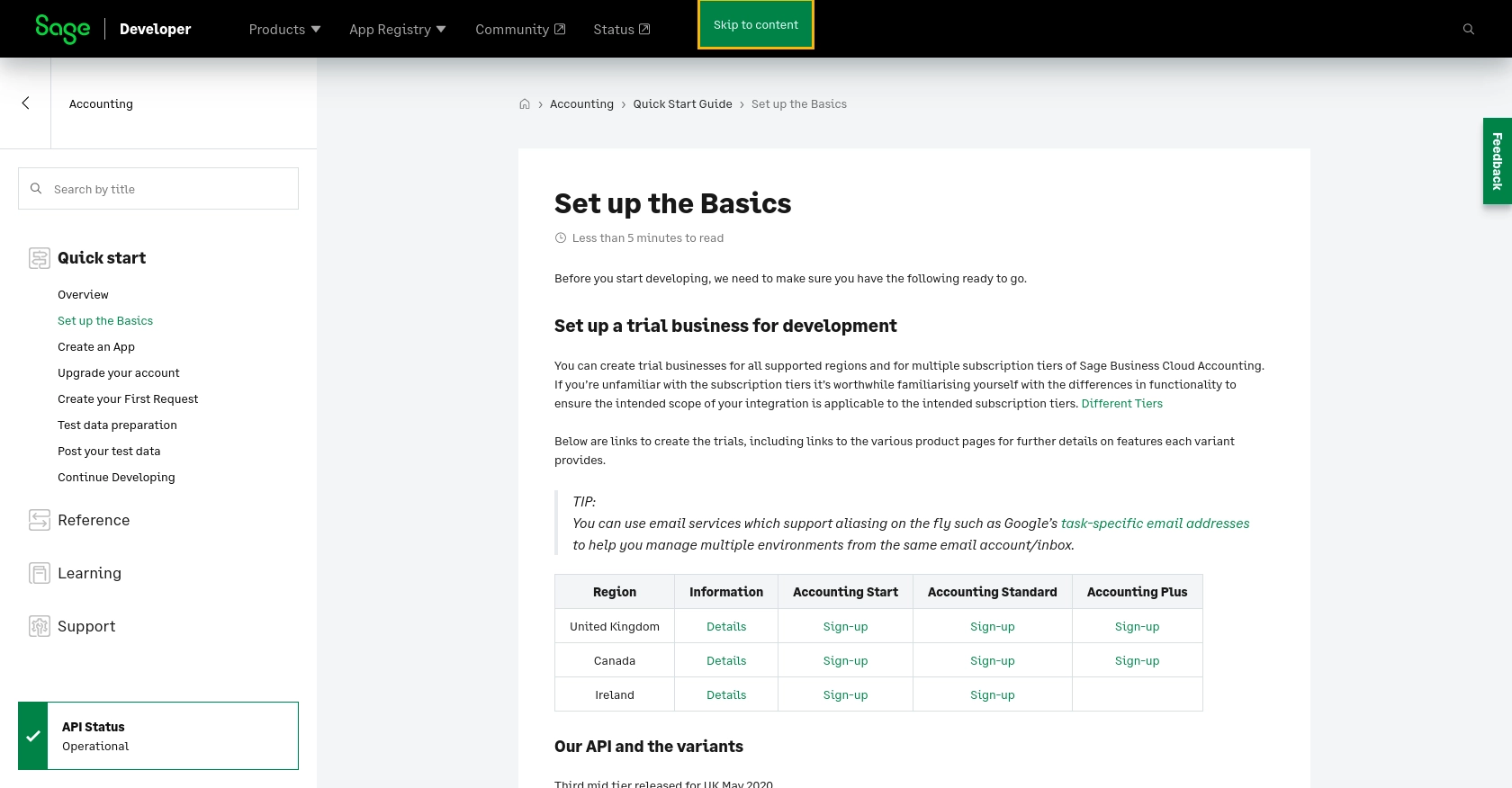

Register a Trial Business for Development

Once your developer account is set up, you can create trial businesses for development purposes. This allows you to test your integration across different subscription tiers of Sage Business Cloud Accounting.

- Navigate to the trial business setup page.

- Select the appropriate region and subscription tier for your trial business.

- Complete the sign-up process to create your trial business.

Create a Sage Accounting App

With your trial business ready, the next step is to create an app within your Sage Developer account. This app will provide the necessary credentials for API authentication.

- Log in to your Sage Developer account and click on "Create App."

- Enter a name and Callback URL for your app. Optionally, provide an alternative email address and homepage URL.

- Click "Save" to create your app. You will receive a Client ID and Client Secret, which are essential for OAuth authentication.

For more details, refer to the Sage Developer Guide on Creating an App.

Upgrade to a Developer Account

To fully utilize the Sage Accounting API, you may need to upgrade your trial account to a developer account. This upgrade provides extended access for testing your integration.

- Submit an upgrade request through the upgrade form.

- Provide details such as your name, email address, app name, and Client ID.

- Wait for confirmation from the Sage team, which typically takes 3-5 working days.

Once these steps are completed, you'll be ready to start making API calls to the Sage Accounting platform using your test environment.

sbb-itb-96038d7

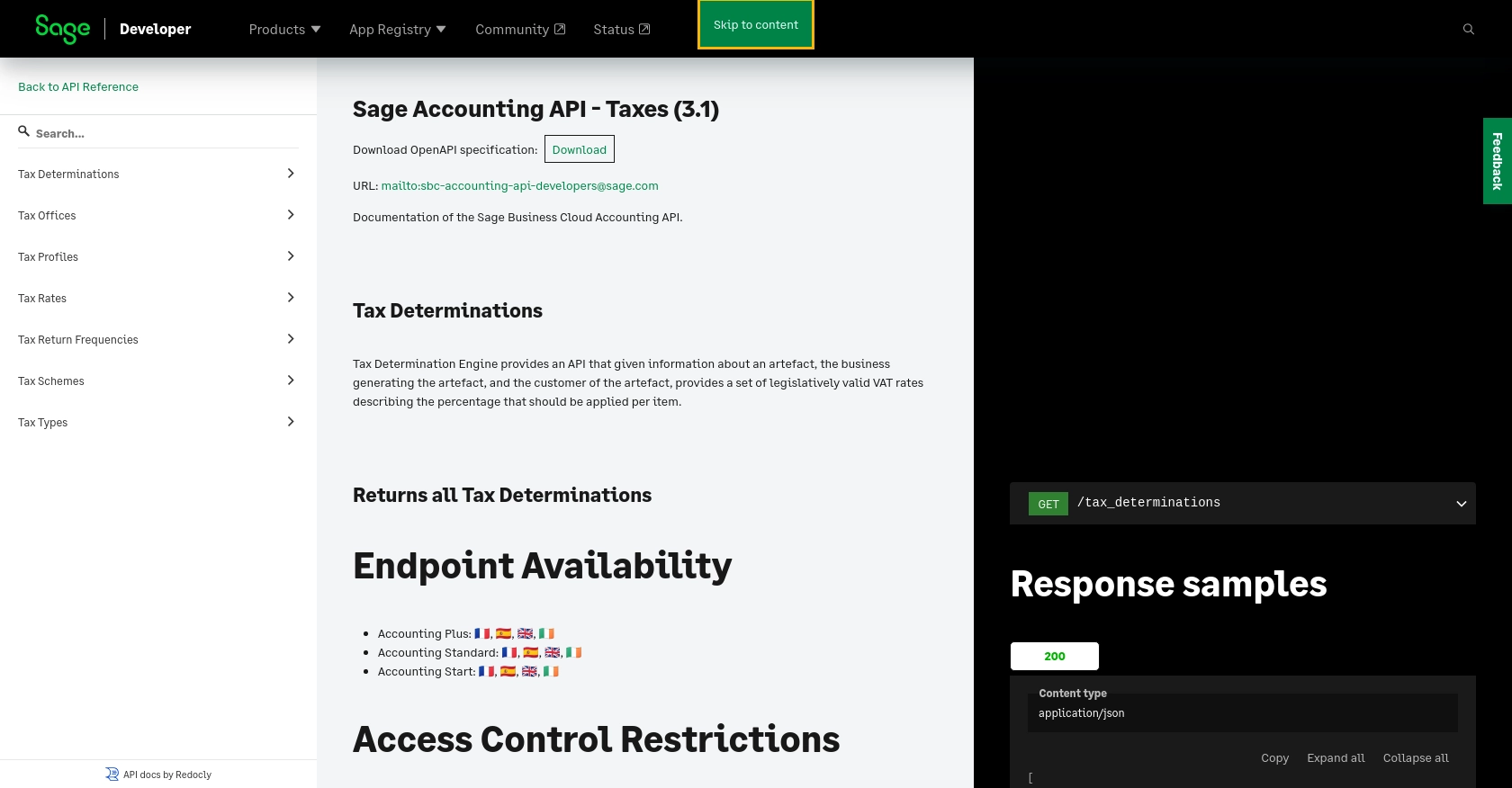

Making API Calls to Retrieve Tax Rates Using Sage Accounting API with Python

To interact with the Sage Accounting API and retrieve tax rates, you'll need to use Python, a versatile and widely-used programming language. This section will guide you through the process of setting up your Python environment, making API calls, and handling responses effectively.

Setting Up Your Python Environment for Sage Accounting API

Before making API calls, ensure you have the following prerequisites installed on your machine:

- Python 3.11.1 or later

- The Python package installer, pip

Once these are installed, open your terminal or command prompt and install the requests library, which is essential for making HTTP requests:

pip install requestsExample Code to Retrieve Tax Rates from Sage Accounting API

Now, let's write a Python script to fetch tax rates from the Sage Accounting API. Create a file named get_tax_rates.py and add the following code:

import requests

# Set the API endpoint and headers

endpoint = "https://api.accounting.sage.com/v3.1/tax_rates"

headers = {

"Authorization": "Bearer Your_Access_Token",

"Content-Type": "application/json"

}

# Make a GET request to the API

response = requests.get(endpoint, headers=headers)

# Check if the request was successful

if response.status_code == 200:

# Parse the JSON data from the response

tax_rates = response.json()

# Loop through the tax rates and print their information

for rate in tax_rates:

print(f"Tax Rate: {rate['name']}, Percentage: {rate['percentage']}")

else:

print(f"Failed to retrieve tax rates. Status Code: {response.status_code}, Error: {response.text}")

Replace Your_Access_Token with the token obtained from your Sage Developer account. This script sends a GET request to the Sage Accounting API to retrieve tax rates and prints them to the console.

Verifying API Call Success and Handling Errors

After running the script, you should see the tax rates displayed in your console. If the request fails, the script will output the status code and error message. Common error codes include:

- 401 Unauthorized: Check if your access token is correct and not expired.

- 403 Forbidden: Ensure your app has the necessary permissions to access the tax rates endpoint.

- 404 Not Found: Verify the endpoint URL is correct.

For more detailed error handling, refer to the Sage Accounting API documentation.

Conclusion and Best Practices for Using Sage Accounting API

Integrating with the Sage Accounting API to retrieve tax rates can significantly enhance your application's financial management capabilities. By automating tax calculations and ensuring compliance, you can streamline workflows and reduce errors, ultimately benefiting your business operations.

Best Practices for Secure and Efficient API Integration

- Securely Store Credentials: Always store your API credentials, such as the Client ID and Client Secret, securely. Use environment variables or a secure vault to prevent unauthorized access.

- Handle Rate Limiting: Be mindful of the API's rate limits to avoid throttling. Implement retry logic with exponential backoff to handle rate limit errors gracefully.

- Data Standardization: Ensure that the data retrieved from the API is standardized and transformed as needed to fit your application's requirements.

- Error Handling: Implement robust error handling to manage different HTTP status codes and provide meaningful feedback to users.

Streamline Your Integrations with Endgrate

Building and maintaining integrations can be time-consuming and complex. Endgrate simplifies this process by offering a unified API endpoint that connects to multiple platforms, including Sage Accounting. By using Endgrate, you can focus on your core product while outsourcing integrations, saving time and resources.

Explore how Endgrate can enhance your integration experience by visiting Endgrate's website. Take advantage of an intuitive integration platform that allows you to build once for each use case, providing a seamless experience for your customers.

Read More

Ready to get started?